US job growth increased more than expected in October, but the pace is slowing and the unemployment rate rose to 3.7 percent, suggesting some loosening in labour market conditions, which would allow the Federal Reserve to shift towards smaller interest rates increases starting in December.

The Department of Labor’s closely watched unemployment report on Friday also showed annual wages increasing at their slowest pace in just more than a year last month. Household employment decreased and the employment-to-population ratio, viewed as a measure of an economy’s ability to create employment, for prime-age workers fell by the most in 2.5 years.

“The foundation of the labour market strength story fades a little when you pull back the tarp and look more closely at the details,” said Christopher Rupkey, chief economist at FWDBONDS in New York. “The report to us looks like payroll jobs growth will falter in coming months as companies batten down the hatches as the Fed continues to take away the economy’s punch.”

The survey of establishments showed nonfarm payrolls increased by 261,000 last month, the smallest gain since December 2020. Data for September was revised higher to show 315,000 jobs added instead of 263,000 as previously reported.

Employment growth has averaged 407,000 per month this year compared with 562,000 in 2021. Economists polled by Reuters had forecast 200,000 jobs, with estimates ranging from 120,000 to 300,000. Still, the labour market remains tight, with 1.9 job openings per unemployed person at the end of September.

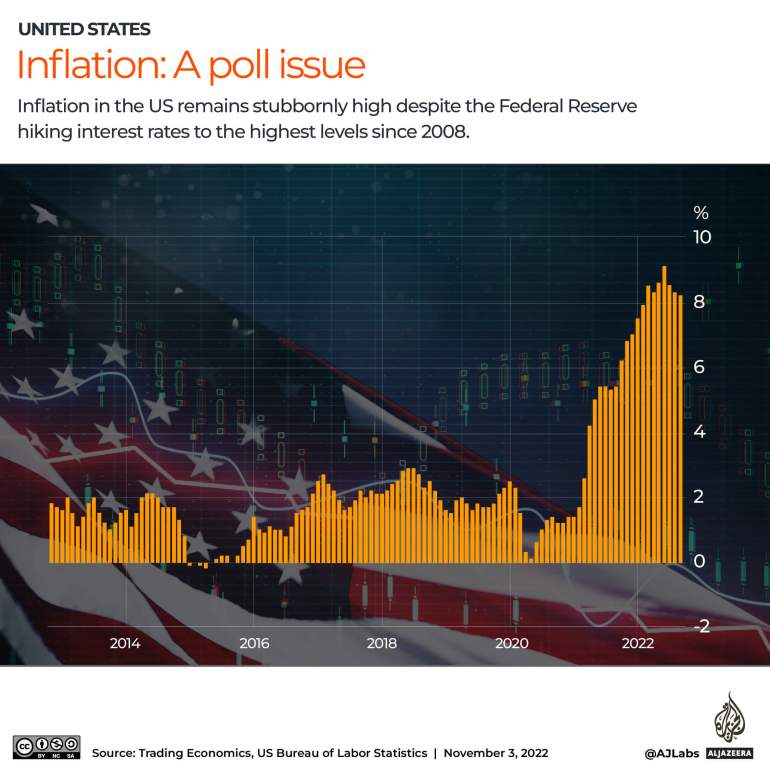

The Fed on Wednesday delivered another 0.75 percent interest rate hike and said its fight against inflation would require borrowing costs to rise further. But the US central bank signalled it may be nearing an inflexion point in what has become the fastest tightening of monetary policy in 40 years.

Last month’s broad-based increase in hiring was led by healthcare, which added 53,000 jobs. Professional and technical services payrolls rose by 43,000 jobs.

Employment in manufacturing rose by 32,000 jobs, while leisure and hospitality added 35,000 positions. Leisure and hospitality employment remained 1.1 million jobs below its pre-pandemic level. The sector had the most job openings.

Government payrolls rebounded by 28,000 jobs. There were moderate employment gains in the interest-rate-sensitive sectors like financial activities and retail trade. Construction payrolls barely rose, while transportation and warehousing added 8,000 jobs.

Hiring still catching up

Betsey Stevenson, an economist at the University of Michigan who was an economic adviser to President Barack Obama, noted that more than half of last month’s net hiring was in industries – healthcare, education, restaurants and hotels, for example – that still appear to be catching up from the sharp job losses they endured during the pandemic recession. Hiring in such sectors will likely continue, she suggested, even if the economy slows.

The “birth-death” model, which the government uses to estimate how many companies were created or destroyed, showed a jump in new business creation estimates, which some economists said could have artificially boosted payrolls.

The birth-death add-factor to the non-seasonally adjusted level of payrolls was 455,000, exceeding the previous October-high of 363,000 in 2021.

“This is well above the 18-year average of 140,000,” said Sarah House, a senior economist at Wells Fargo in Charlotte, North Carolina.

Others, however, were sceptical, noting that the large birth-death factor followed a 172,000 drop in September.

Stocks on Wall Street were narrowly mixed. The dollar fell against a basket of currencies. US Treasury prices were mixed.

Slower pace in labour market

Job growth has persisted as companies replace workers who have left. But with recession risks mounting because of higher borrowing costs, this practice could end soon. A survey from the Institute for Supply Management on Thursday found some services industry companies “are holding off on backfilling open positions,” because of uncertain economic conditions.

Average hourly earnings increased 0.4 percent after rising 0.3 percent in September. Wages climbed 4.7 percent year-on-year, the smallest gain since August 2021, after advancing 5 percent in September as last year’s large increases fell out of the calculation.

Other wage measures have also come off the boil, which bodes well for the inflation outlook. Inflation data next week is expected to show the annual increase in consumer prices slowing to below 8 percent for the first time this year.

But with inflation shifting to services, the battle against higher prices will be a long one.

Details of the household survey from which the unemployment rate is derived were soft. The increase in the unemployment rate from 3.5 percent in September reflected a 328,000 decline in household employment. The ranks of the unemployed increased 306,000.

“While there is slowing in the pace of labour market activity, that slowing has been much too gradual and today’s report leaves the Fed on track to hike at least 50 basis points at next month’s meeting,” said Michael Feroli, chief US economist at JPMorgan in New York.

About 22,000 people dropped out of the labour force, pushing the participation rate, or the proportion of working-age Americans who have a job or are looking for one, to 62.2 percent from 62.3 percent in September.

There was also an increase in the number of people unemployed for 27 weeks and more. But the number of people working part-time for economic reasons fell.

The employment-to-population ratio for workers in the 25-54 age group dropped 0.4 percentage points to 79.8 percent. The decline was the largest since April 2020.

The rate at which unemployed people are finding jobs slowed to 26.7 percent from 28.6 percent in September.

“There’s some very clear signs of slowdown, and that could be a moderation, but depending on a variety of factors that moderation can turn into a deterioration,” said Nick Bunker, head of economic research at the Indeed Hiring Lab. “The hope is that the labour market is merely returning to a more normal pace, rather than sitting dead in the water.”

Sumber: www.aljazeera.com

Skip to content

Skip to content